To the chagrin of many metals investors, gold’s tumbled through some key support levels last week. Bullion was off 2.2 percent through Thursday. Friday started off—and ended—badly. Heading into the weekend, gold dropped another eight bucks to just under $1,230. The metal’s now flat for the year after being up as much as 13 percent.

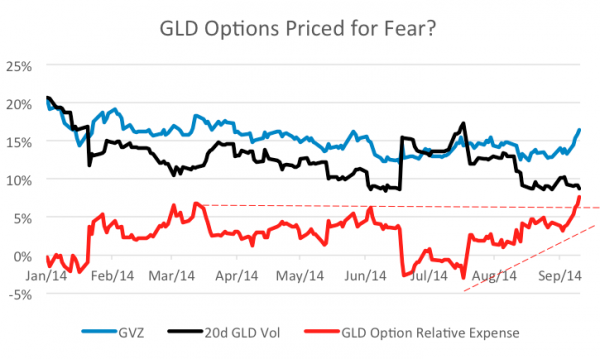

The current sell-off didn’t come out of the blue. Its depth, in fact, was telegraphed by the option market. Embedded in every option’s price is an assumption of future volatility for its underlying asset. Most folk nowadays know about VIX, the volatility index derived from options on the S&P 500 Index. VIX is known as a fear index, spiking higher when stock investors are spooked.

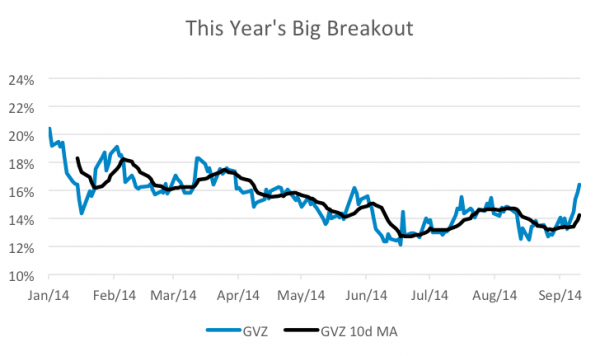

VIX has an analog in the gold market. GVZ measures the expected near-term volatility in the SPDR Gold Shares Trust (NYSE Arca: GLD). This week, GVZ shot up from its late summer doldrums. Even so, GVZ isn’t anywhere near the levels seen at the top of the year, a fact that may lull some traders into thinking the current selloff doesn’t have legs.

But if you look at GVZ’s relationship to GLD’s historic volatility, you’ll see a breakout in the fear direction. GLD options are more expensive than they’ve been all year relative to GLD’s actual price variance. Option sellers typically goose up premiums in anticipation of big moves. And this past week, they jacked up prices big time.

How big? GVZ’s Thursday reading was 15 percent higher than the index’s 10-day moving average—the widest premium of the year. This served as a backdrop for GLD taking out intermediate support at the $119 level. With that out of the way on Friday, option traders now seem to be pricing in a test of secondary support at $114-115.

Brad Zigler pens Wealthmanagement.com's Alternative Insights newsletter. Formerly, he headed up marketing and research for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.