Gertrude Stein wouldn’t have done well in today’s interest rate environment. Invoking the law of identity, she famously intoned “Rose is a rose is a rose is a rose” in a 1913 poem. ‘Tain’t necessarily true of the Treasury market, though.

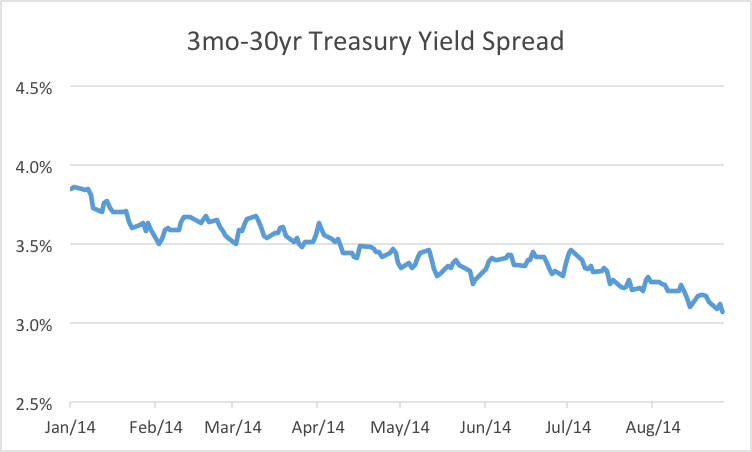

For evidence of that, look no further than the yield curve. It’s flattened big time in 2014. In fact, the spread between three-month bill and long bond yields is now just barely above three percent, the narrowest range since May 2013.

Rates have fallen precipitously on the left, or long, side of the curve due to safe haven buying and roll-downs. Since the top of the year, 30-year rates have dipped by 81 basis points while one-year yields have actually risen by 19. That doesn’t mean that the buying’s been concentrated in the long bond, however. If the ETF market is any guide, investors have really favored the middle maturities.

Take a look at the creation activity in BlackRock’s iShares complex of Treasury bond fund and you’ll see most of the money’s been flowing into 7- to 10-year paper.

|

Ticker (Maturity Bucket) |

YTD Gain/Loss (Market Price) |

Assets Under Management |

YTD Change In AUM |

|

SHY (1-3 Years) |

0.14% |

$9,109.1 mm |

9.5% |

|

IEI (3-7 Years) |

1.44% |

$3,857.3 mm |

41.2% |

|

IEF (7-10 Years) |

5.14% |

$7,855.4 mm |

97.6% |

|

TLH (10-20 Years) |

8.75% |

$315.8 mm |

31.8% |

|

TLT (20+ Years) |

15.84% |

$4,355.6 mm |

57.5% |

As you can see, the asset base for the iShares 7-10 Year Treasury Bond ETF (NYSE Arca: IEF) has nearly doubled this year. Which naturally leads us to wonder if this fund is likely to see the most dramatic outflows once yields start rising.

Turning back to Ms. Stein, she may not have been much of a bond trader, but she clearly had opinions. “Action and reaction,” she once said, “are equal and opposite.”

Duly warned.