You know, the more I think about exchange-traded notes, the more I tend to dislike them. Oh, don’t get me wrong, there are some decent products out there. But there’s also an awful lot of dreck.

Take the iPath U.S. Treasury Flattener ETN (NYSE Arca: FLAT) for example. The basic concept upon which the note is built is a fine one, actually. The note is supposed to supply unlevered and inverse exposure to the Barclays 2Y/10Y Yield Curve Index. The index tracks the returns of long and short positions in 2-year and 10-year Treasury notes, respectively. FLAT appreciates as the yield spread between the notes narrows.

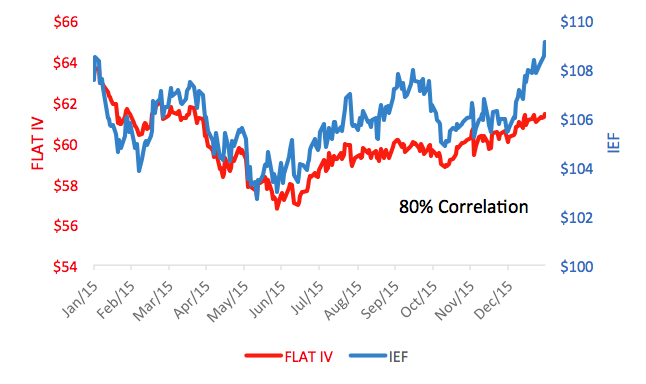

And that it does. In its fashion. The end-of-day indicative value (IV) of the note has gained 1.9 percent since the top of the year. In that time, the spread between the 2-year and 10-year notes has come in 3 basis points.

For the privilege of FLAT ownership, though, you fork over a 75 basis point annual fee and accept the risk of a remarkably illiquid investment. On average, less than 1,000 notes a day changed hands over the past year. So, with an average price around $60, it would seem that you could be the market if you had to swap into or out of a $60,000 position on any given day. Ah, but it’s worse than that. There was no volume – nada, zilch, bupkes – on 54 percent of FLAT’s trading days over the past 12 month.

Worst of all, though, is the credit risk you assume. The notes are unsecured debt obligations issued by Barclays Bank plc. If Barclays goes under before the notes mature in 2020, you could lose everything. Is that likely? Perhaps not, but if the trend is your friend, Barclays is a fair weather acquaintance at best. Back in 1988, the bank was a AAA credit. It’s since slid steadily to A- with four downgrades in the last eight years alone.

So, what’s the alternative if you believe the curve will continue to flatten? Well, you could construct a D-I-Y version like the one assembled in our 2013 article, “Bargain Hunting Along The Yield Curve” (http://wealthmanagement.com/alternative-investments/bargain-hunting-along-yield-curve). Or you can just buy the iShares 7-10 Year Treasury Bond ETF (NYSE Arca: IEF). Over the past year, this exchange-traded fund (not, mind you, a note) exhibited an 80 percent correlation to FLAT. Year to date, it’s cranked out a 3.3 percent gain. It pays dividends. There’s no credit risk. It’s cheaper, too. The fund’s annual expense ratio is just 15 basis points. And you can trade the fund, in size, all day long. It’s average daily turnover is 1.9 million shares.

There’s something to be said for keeping things simple.