Two weeks ago, before the winter flu bug bit me, I fretted about a big move looming in bullion (see “Something’s Brewing In The Gold Market")

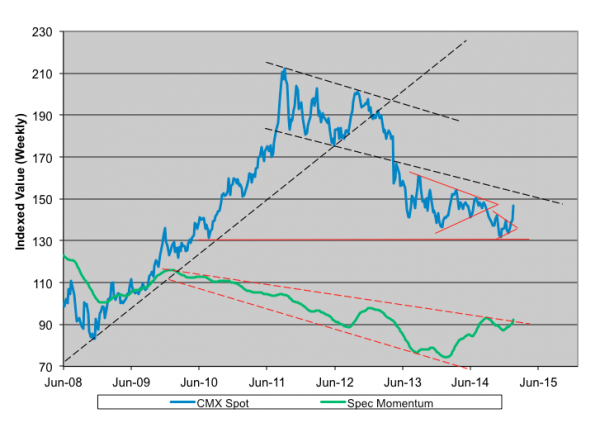

Well, it happened. Spot metal shot up about $75 since I penned the column. The weekly Comex chart tells the story best. Not only has gold’s price broken to the upside (blue line) but speculative momentum (green line) has also stirred.

Let’s look at the price action first. Last week, Comex gold pushed above its 200-day moving average, something that hasn’t happened since last August. Gold is rebounding after a test of support at $1,158. You can see, however, that the down channel line going back to 2011 still weighs on the spot price. To punch through overhead resistance, bullion really needs a weekly close above $1,570. That translates to a $150 print in the SPDR Gold Shares Trust (NYSE Arca: GLD).

Now, about that speculative momentum. Last week, money managers grabbed gold futures hand over fist. On a net basis, the number of advisors trading from long positions increased 41 percent. That accounts, in large part, for a surge in net speculative length. The net long position held by speculators of all sizes and descriptions totals more than 200,000 contract equivalents (futures together with options) for the first time in two years. GLD saw inflows as well. Bullion tonnage backing the gold shares has grown to levels not seen since October.

So, is it time to peel off the straddle recommended two weeks ago? You certainly couldn’t be blamed if you did. As of Friday, the March $117 package was worth $865, better than a 33 percent gain.

There’s something to keep in mind, though. For speculators to have bought all those Comex contracts, somebody had to sell them. Those sellers were commercials – producers and users of gold. Commercials are often thought of as “smart money.” After all, their businesses depend on being finely attuned to the vagaries of bullion pricing. Commercials’ net short futures position ballooned to record size last week. The last time net shorts reached such levels was July 2014 when gold peaked at $1,326.

Brad Zigler is REP./WealthManagement's Alternative Investments editor. Previously, he was the head of marketing, research and education for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.