It’s a head-spinning market for investors now. Are bonds too expensive or are stocks? In a word, “yes.” You could argue that neither equities or fixed income securities are cheap. Allow me to explain

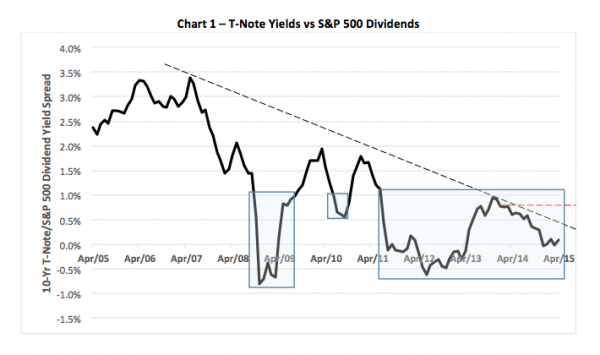

The spread between S&P 500 dividends and the payout from ten-year Treasury notes is a closely followed metric of the relative value of stocks. Research done by Standard & Poor’s shows stocks most likely to advance within a year of the dividend rate equaling or exceeding the note yield. It makes sense doesn’t it? If stocks pay the same (or more) than notes, investors view equities as a better investment. Dividends, after all, can be raised. Coupon payments are fixed.

Currently, the ten-year note payout is just 34 basis points (0.34 percent) higher than the S&P dividend yield. Stocks, by that measure, aren’t particularly cheap but neither are they overpriced. If anything, it’s bonds that look pricey.

Over the past ten years, the ten-year yield premium has averaged 1.2 percent. With that as a benchmark, you could say that bonds have been consistently rich since June 2011. That’s 47 straight months of “overpriced” notes, a streak that far exceeds the 12-month stretch in the depths of the 2008-2009 Great Recession (See Chart 1; “overpriced” periods are highlighted in blue).

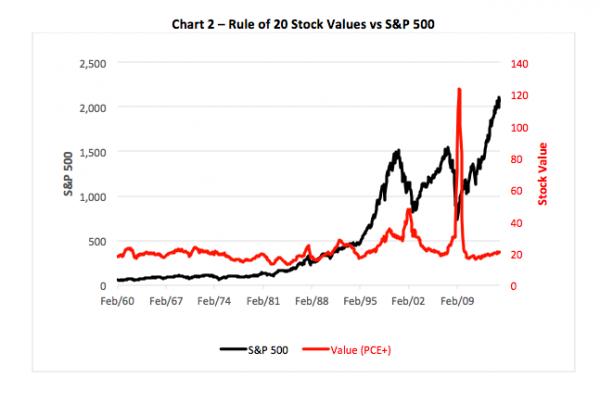

Three decades ago, Jim Moltz of ISI Group devised the so-called “Rule of 20” to gauge the relative value of stocks. Basically the rule defines stocks as fairly valued when the sum of the S&P 500 price-earnings ratio and the current inflation rate approximates 20. Extreme variances from fair value presage significant wrenchings in stock prices.

If you look at Chart 2, you can see upward excursions in the metric (here, chained personal consumption expenditures – the Fed’s favorite inflation benchmark – is used as the addend) preceded steep selloffs in the S&P index.

Not Poised For a Big Tumble

By this measure, stocks seem fairly priced now but not poised for a big tumble. As long as inflation remains subdued, that is. Moltz probably didn’t anticipate the effect of deflation on stocks, though.

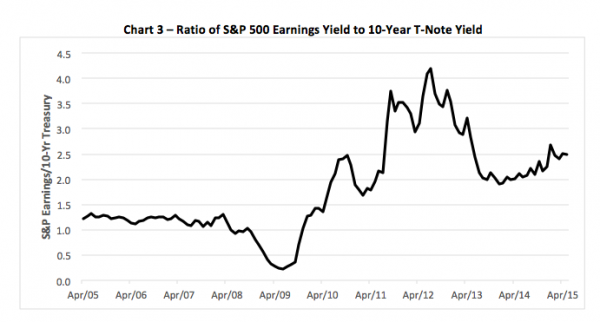

Yet another way to look at the relationship between stocks and medium-term notes is through the lens of the S&P 500 earnings yield. The earnings yield is simply the inverse of the index’s price-earnings ratio. A low earnings yield typically denotes an expensive equity market while higher yields bespeak cheap stocks.

Historically, near-term stock gains are most likely when the earnings yield rises to double that of the ten-year note payout.

According to Standard & Poor’s, the ratio has averaged 1.6 since the end of World War II. And now? The ratio’s at 2.5 after bottoming just south of 2 in early 2014.

This suggests that stocks may likely outperform bonds and notes over the coming year, provided the rate and inflation environments don’t erode corporate balance sheets.

So, all told, while stocks aren’t the screaming bargains they once were, the odds still favor more upside than downside.

Brad Zigler is REP./WealthManagement's Alternative Investments Editor. Previously, he was the head of marketing, research and education for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.